Best Book to Read About Personal Finance and Taxes as a Young Man

Books Nigh Investing

Investing is a complex topic. Luckily, several experts have written books about stock market investing, real estate investing and everything in betwixt — sharing their ain experiences and mistakes in the investing world. These, and other highly rated books on investing, offer valuable insight into investing and avoiding the common mistakes investors make.

one. The Bogleheads' Guide to Investing (Second Edition)

If you're a starting time investor and don't know where to start, this volume can guide yous through the process. With multiple authors, the book offers a rich, thorough perspective on the fundamentals of investing and making your money work for you. The authors also intermission downwardly circuitous financial concepts in a way that is easier to understand.

2. A Random Walk Downward Wall Street

"A Random Walk Down Wall Street" explores history, economics, marketplace theory and other concepts to provide investors of all ages with solid advice. Burton Chiliad. Malkiel discusses the mathematics of investing to highlight its importance and emphasizes common mistakes investors make and how to avoid them.

Malkiel is a long-fourth dimension financial investor and the Chemic Banking concern Chairman's Professor of Economics at Princeton University. He'southward written more than x books on the topic of personal finance and investing, including several editions and updates of "A Random Walk Downward Wall Street."

3. The Book on Rental Property Investing

Brandon Turner, host of the BiggerPockets podcast, takes a newer approach to investing past placing his funds in real estate — which, according to the millionaires of The Oracle, is still one of the best investments. In his book, Turner details his early days in real estate investing and how it has led to financial liberty, while offering his personal tips for success.

Turner walks readers through the steps of existent estate investing, focusing on a specific concept in each chapter. If you're looking to invest in real estate, this volume should exist on your reading listing.

Books Near Becoming Wealthy

When looking for books about building wealth, don't be deceived. There's no piece of cake way to do information technology. These books offer advice on condign wealthy and fugitive pitfalls, but they won't help you go rich quick. Wealth comes from knowing how to make your money work for you and how to make information technology terminal.

four. Everyday Millionaires

Don't exist surprised if this book changes the way you view America'southward wealthy. Writer Chris Hogan talks with real people around the nation about their secrets to amassing a cyberspace worth of $1,000,000 or more. He shares their tips and discusses ways for people on almost any income to grow their wealth.

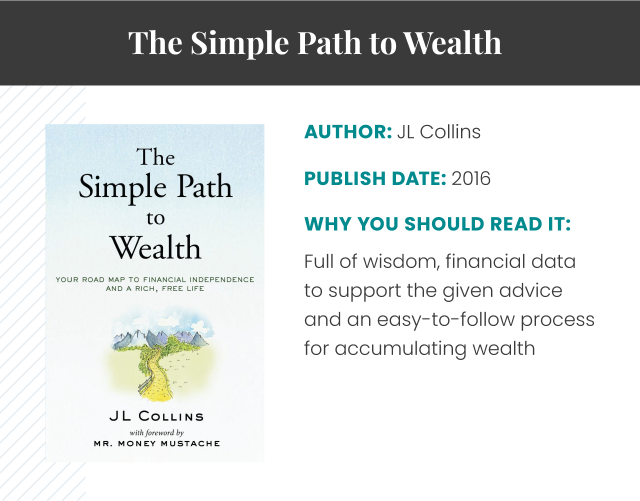

5. The Unproblematic Path to Wealth: Your Route Map to Financial Independence and a Rich, Free Life

JL Collins breaks things downwards in his book, "The Elementary Path to Wealth." He takes readers through the process of accumulating wealth, providing them with financial data to support the concepts in the book. With roughly 4,100 five-star reviews on Amazon and more than 11,000 ratings averaging 4.v stars on Goodreads, it's safe to say this book steals the bear witness with its solid, easily digestible advice.

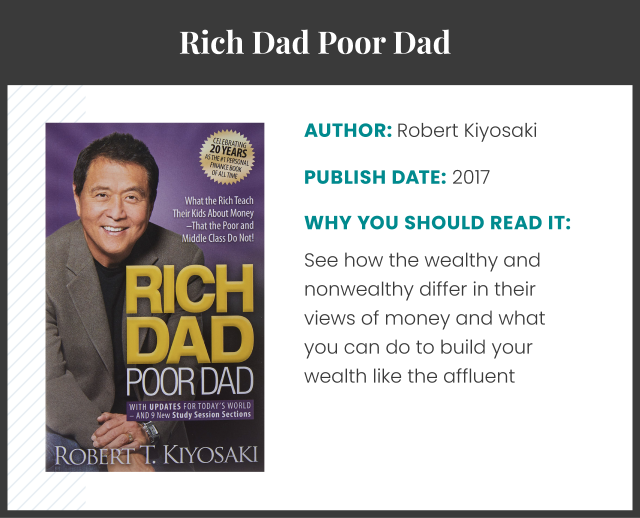

6. Rich Dad Poor Dad

Robert Kiyosaki reveals what he learned from his own father and his friend's male parent (who he saw as a father figure) in his best seller "Rich Dad Poor Dad." With countless lessons for those who seek to build wealth, this book non only shows readers the difference between the wealthy and the nonwealthy in regard to their perception of money, only information technology too provides actionable steps for making your money work for you lot.

Books About Retirement Planning

Virtually of us plan on retiring at some point, but many don't think much of it until they offset endmost in on 65. However, early preparation for retirement tin allow yous to live the retirement lifestyle you want, rather than settling for only what you tin afford.

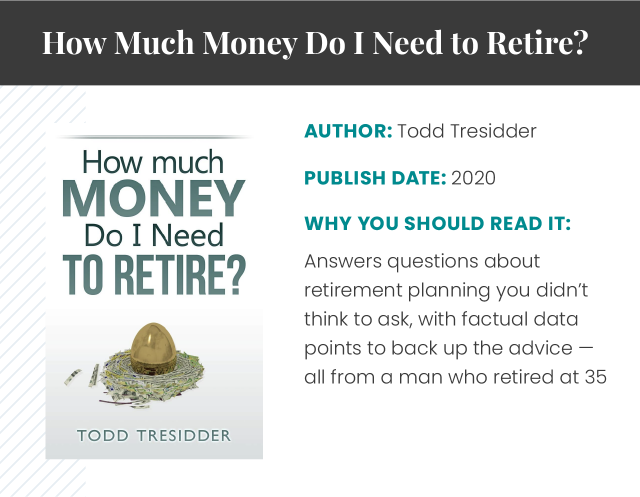

vii. How Much Coin Do I Need to Retire?

With rave reviews, this book is a must-read for anyone on the route to retirement. Todd Tresidder reveals v of the most important questions to ask when planning for retirement, explains how to estimate returns on your investments and explores living expenses in retirement. This comprehensive book covers retirement planning and post-employment cash period.

Tresidder provides readers with specific data points to illustrate the failure of traditional retirement plans, and encourages them to see beyond those plans in new and creative ways. With a degree in economics and a big and successful portfolio, Tresidder — who retired at historic period 35 through savvy investing — is truly an good when information technology comes to paving the manner to a slap-up retirement.

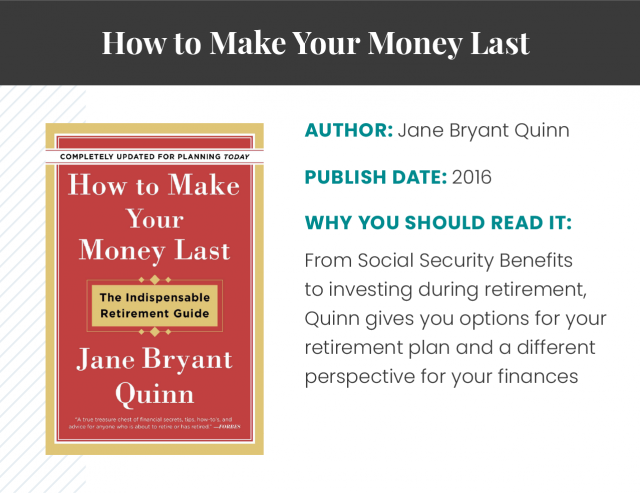

8. How to Make Your Coin Last

A slap-up read for anyone — whether already retired or on their way. Author Jane Bryant Quinn writes in a straightforward style, fugitive the fluff and giving readers the information they're looking for. Quinn discusses common retirement topics, from how to handle home equity to managing savings through annuities and other means.

Not only does this financial genius explain the basics of finances and budgeting during retirement, simply she likewise offers advice on continuing to earn an income and stretching your coin during those post-working years.

nine. AgeProof: Living Longer Without Running Out of Money or Breaking a Hip

Equally leading experts in the realm of wealth and wellness, Jean Chatzky and Michael F. Roizen examine the connectedness between healthy aging and healthy finances. From catching upwardly on retirement savings for belatedly starters to making the nigh of your health and retirement benefits — readers will find valuable advice in this volume.

Chatzky is the CEO of HerMoney.com and hosts her ain podcast. She was the financial editor of NBC Today for 25 years and has appeared on CNN, MSNBC and The Oprah Winfrey Show. Dr. Roizen is a medical professional person who has penned several best sellers.

Books About Budgeting

Even if yous think your budgeting methods are expert enough, you can e'er learn more about getting the most out of your money. Whether you're creating a retirement upkeep or a newlywed budget, these budgeting books can help you get started.

10. The Financial Diet

With loads of practical advice on managing your money, "The Financial Diet" won't steer you wrong. In it, author Chelsea Fagan offers her personal financial experience and communication and that of other financial experts. In improver to learning almost budgeting and investing, readers will glean insight on a range of fiscal topics, including mortgages and talking to your friends about money.

11. How to Manage Your Coin When Yous Don't Accept Any

This book was written specifically for those who struggle with managing money, no matter their income. It's one of few books on this list that talks explicitly about the tough challenges many Americans face up when information technology comes to their personal finances and the economy. Author Erik Wecks provides readers with uncomplicated and actionable principles that employ to everyday life.

12. The One Week Budget: Learn To Create Your Money Direction System in 7 Days or Less!

Author of "The One Week Budget," Tiffany Aliche channels her financial wisdom toward helping women achieve financial success. However, this volume's step-past-pace instructions are invaluable for men and women akin.

Having been featured on Good Morning America, TODAY, and in The New York Times, Aliche understands the fine points of finance, and she'due south eager to share her knowledge. A teacher at eye, Aliche is able to simplify money-management concepts and make them accessible to those who aren't familiar with budgeting practices.

Books for Recent Graduates

Going out into the world and earning a steady income can be satisfying for contempo graduates. However, you may be tempted to use your coin in ways that won't benefit you in the long-run. You may also observe that you're not sure how to manage this new income or pay off pupil loan debt. The titles below tin can assistance you learn how to do all of this and more.

xiii. Broke Millennial

Writing specifically for millennials, Erin Lowry touches on cardinal points this age group struggles to understand. From managing educatee loans to talking with a partner virtually debt, Lowry speaks directly to those simply getting started in the world of personal financial management. Her communication is simple enough to follow but profound enough to get out an impact on your life.

14. I Will Teach Yous To Be Rich (2d Edition)

Finance guru Ramit Sethi dives into financial topics that teach readers how to seamlessly manage their money without stress. From how to handle car ownership to paying for a nuptials and automating finances, Sethi introduces twenty-somethings to a world gratuitous of financial guilt.

Having studied psychology at Stanford, Sethi understands the psychology of earning, saving and investing coin. For those interested in learning how to manage money and build wealth, this New York Times best seller has got y'all covered.

fifteen. Become a Fiscal Life: Personal Finance in Your Twenties and Thirties

With the struggles 20- to xxx-year-olds face, it'south no wonder Beth Kobliner has released a fourth edition of this pop personal finance book. Sharing tips on figuring out taxes, avoiding common coin mistakes and eliminating debt, Kobliner understands the prominent issues in today's economy.

16. The Next Millionaire Next Door

Similar to "Everyday Millionaires" author Chris Hogan, Thomas Stanley and Sarah Stanley Fallaw outline the traits and qualities of America'southward wealthy. They discuss the foundations of building wealth and how almost anyone can exercise it. A great read for recent higher graduates striving to build their wealth from the ground up.

17. Your Money Life: Your 20s

Full of practical money advice for those in their 20s, this book is a must-read for those figuring out how to manage their finances. Whether you're starting from the basics or already know a thing or ii about coin, this volume will go out you with actionable tips to meliorate command how your money goes in and out.

eighteen. Spend Well, Live Rich

Michelle Singletary'southward "Spend Well, Live Rich" doesn't disappoint. With seven different financial mantras and ways to manage coin on any budget, this volume was written mainly for people without all-encompassing fiscal cognition. Singletary provides specific tips on managing coin for a life a life of financial freedom, no matter your financial situation.

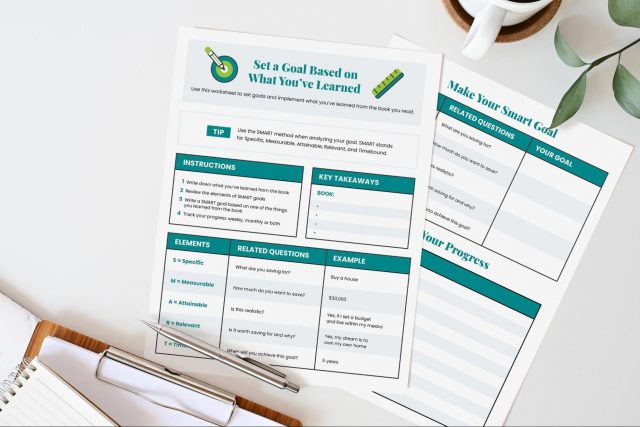

Implementing What You Learn

A volume is merely as good equally what yous take abroad from it, so it's important to fix goals based on what yous learn and have a fashion to continue track of your progress. You can practise this with a notebook, in the volume itself if you ain it, with friends who will go along you answerable or in any other way that will help y'all.

Because implementing what you learn and tracking your progress is so important, nosotros've created a printable goal and tracking sheet below to assist yous become started.

By reading personal finance books, you lot tin can brainwash yourself on a wide range of topics, including investing, budgeting, mortgages and other loans, retirement, annuities, insurance and more than. And don't forget almost resources that make learning fun and convenient, such equally audiobooks, e-books, and your local library.

mcmullencuble1953.blogspot.com

Source: https://www.annuity.org/financial-literacy/personal-finance-books/

0 Response to "Best Book to Read About Personal Finance and Taxes as a Young Man"

Post a Comment